Summer 2021 Market Report

Market Report

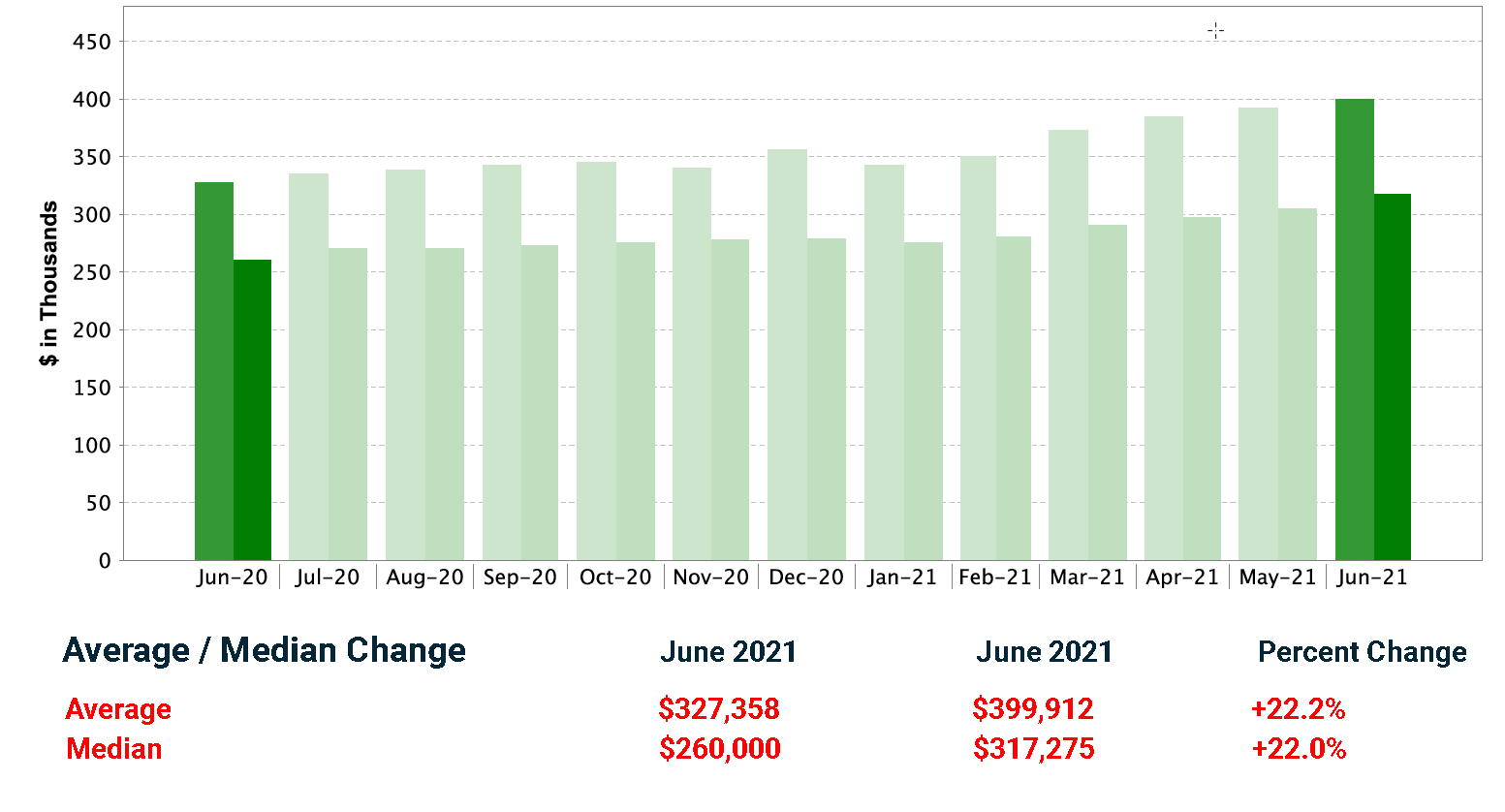

The Tampa Bay real estate market has gotten off to another scorching year so far, and there doesn’t appear to be any looking back. The Tampa Bay market (Hillsborough, Pinellas, Pasco, Manatee) has seen unprecedented home appreciation gains over the past year. At the time of this writing, the average YoY growth is 22%, up to $399K from $327K one year prior (price increase of $72K). For those of us who remember the crash of 2008 and Great Recession that followed, it may feel like we're riding another bubble, but I can assure you what we're seeing now is something completely different.

Unlike last time, credit-tightening standards mean qualifying for a mortgage is still pretty difficult, so if we're witnessing another housing bubble and it does pop, fewer people are at risk of default. Right now, there's no reason to expect standards will loosen up in the immediate future because tightness has been years in the making. Having overbuilt in the 2000s, chastened homebuilders underbuilt in the 2010s.

The case against calling this a bubble is pretty straightforward. Prices are rising simply due to the basic economic principle of “supply and demand.” Supply issues paired with our country's current change in demographics is creating the perfect storm. As of 2020, millennials surpassed baby boomers as America’s largest home-buying demographic (37%). It’s no surprise that as they reached the age when people generally begin buying homes, there'd be a sharp increase in demand.

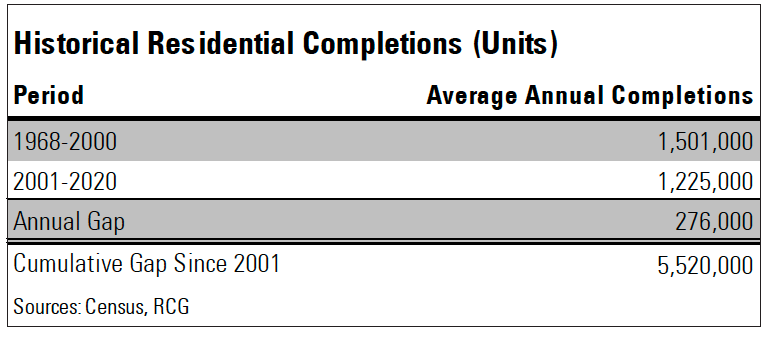

However, the most important factor is low supply. Having a bunch of first-time homebuyers enter the market wouldn’t be that big of a deal if the market could accommodate them. In 2018, two years prior to the Covid-19 pandemic, a Freddie Mac report claimed a housing shortage of 2.5 million homes. Builders were hit hard by the real estate crisis of 2008, and it took a long time for them to get back on their feet and resume normal operations. As a result, the supply of new units fell well behind the mounting need for the demand arising simply from the growth in the number of households.

According to NAR, the housing deficit has now grown to 5.5 million housing units needed to balance the market. If we were to increase our current yearly output by approximately 60%, an increase of more than 700,000 units per year, while accounting for historical growth, it would still take 10 years to reach the additional 5.5 million units needed to offset the housing deficit.

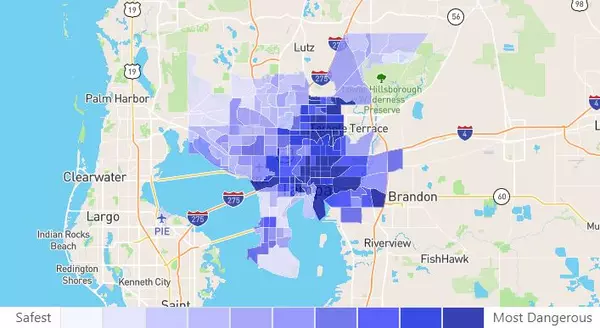

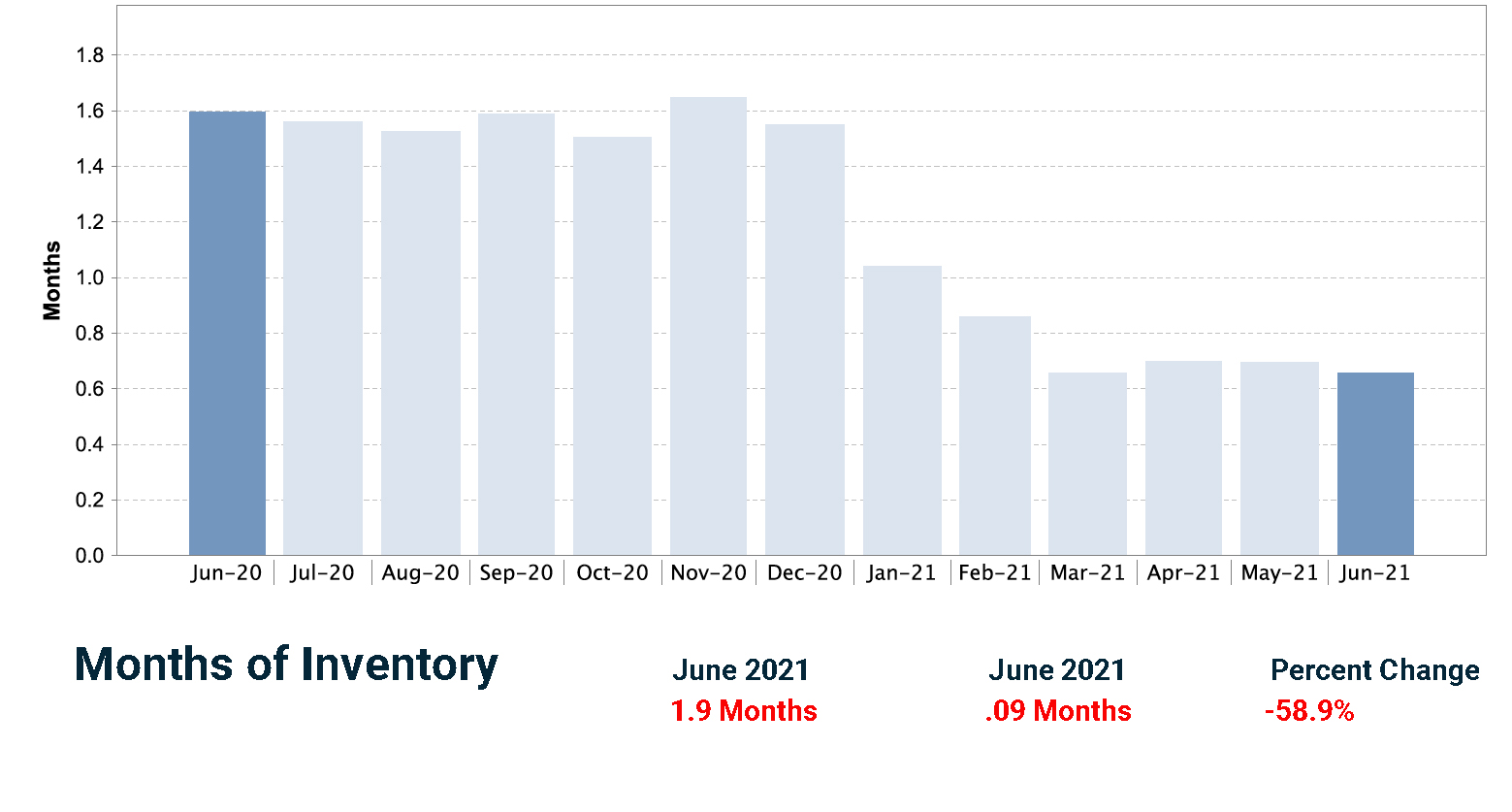

Tampa and many other markets considered to be secondary or nontraditional markets have also seen an additional spike in demand, because of Covid-19 and remote work. This has allowed some portion of the population to relocate to cheaper markets with better weather, and even better sports teams (AKA Champa Bay), where they can easily outbid locals. When a typical local market buyer purchases a home, they return one back to the pool, but when a significate portion of the buyers are from outside that market there's nothing to trade back into the pool, further accentuating the housing shortage. Currently, the Tampa Bay inventory supply is down -59% YoY with .9 months of supply.

Whether we call it a housing bubble or not, the current situation isn’t stable, and there are simply NOT enough homes to meet the demand for would-be homeowners. We should expect builders to expand their outputs, but scaling will take time. Local municipalities and governments also need to help by incentivizing builders and investors, as well as expediting their processes and loosening strict zoning regulations. We don’t have a crystal ball, but given the existing metrics, we should expect to stay in the current seller’s market for another three-plus years, potentially much longer, unless there's another outside force that impacts the market in a way we can’t measure today.

In short, if you’re a seller, it’s a great time to sell for max value. But if you're a buyer right now, expect to pay more than the listing price, in many cases, with multiple offers. If you are a buyer or thinking about becoming one, be prepared for an uphill battle at least for the next several years. If you're a buyer thinking about sitting this one out, we don't blame you. However, ask yourself if you'd be willing to pay 20% or more a year from now, and who knows how much more if you wait longer than a year. The current seller’s market isn’t going anywhere for the time being.

Categories

Recent Posts